Navigating Newport Beach, California's Luxurious Real Estate Market

Let's break down these real estate metrics to understand how they are correlated and what they mean for both buyers and sellers in the vibrant Newport Beach market.

Inventory and Market Balance

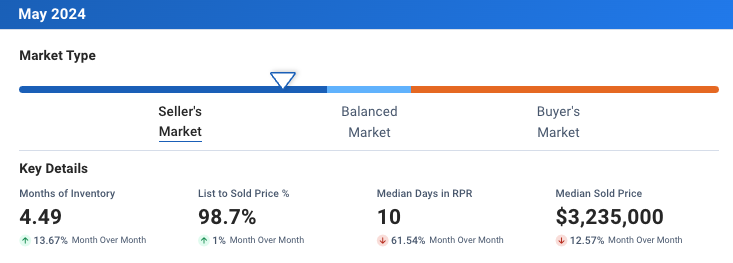

First, let's look at the Months of Inventory, which is currently at 4.49. This number indicates how long it would take to sell all the current homes on the market at the current pace of sales. Typically, a lower number indicates a seller's market, where demand exceeds supply, leading to potentially higher prices. However, a number around 4.49 suggests a more balanced market, where the supply and demand are relatively even.

The 12-Month Change in Months of Inventory shows an increase of 15.13%, indicating that the market may be shifting towards a more balanced or even a buyer's market. This could mean more options for buyers and potentially more negotiation power as the market equilibrium changes.

Speed of Sales

The Median Days Homes are On the Market is only 10 days. This swift turnover rate highlights that homes are selling quickly, likely due to high demand and limited inventory. For sellers, this is a positive indicator, suggesting that they can expect to sell their properties rapidly, benefiting from the current market dynamics.

Pricing Trends

The List to Sold Price Percentage of 98.7% indicates that homes are selling very close to their listing prices. This suggests that sellers are pricing their homes accurately and buyers are willing to pay near the asking price. It also reflects a market where pricing strategies are effective and realistic, minimizing drastic price negotiations.

Market Value

Lastly, the Median Sold Price stands at $3,235,000. This substantial figure places Newport Beach firmly in the luxury market segment. Buyers looking in this area should be prepared for higher prices, but they can also expect high-end features and amenities that come with this price range. This median price underscores the premium nature of Newport Beach real estate, known for its beautiful coastal views and upscale living.

Conclusion

Overall, these metrics suggest a competitive market with low inventory, quick sales, and high prices. Buyers should act quickly and be prepared to make strong offers, while sellers may benefit from the current demand and potentially higher prices. Whether you're a buyer or a seller, working with a knowledgeable real estate agent is crucial to navigating these market conditions effectively.

For expert guidance and personalized service in Newport Beach, California, contact Louis DiGonzini at 949-922-8420 or Ldigonzini@thedigonzinigroup.com. With the right strategy and support, you can successfully navigate Newport Beach’s luxurious and dynamic real estate market.

Happy buying and selling!

Don't miss your chance to explore the perfect property or get expert advice on your next real estate venture. Contact Louis DiGonzini today for a personalized consultation that aligns with your unique aspirations.

📞 Call Now: 949-922-8420

📧 Email: Ldigonzini@thedigonzinigroup.com

DRE #01502775

Take the first step towards making your real estate dreams a reality with Louis DiGonzini, your trusted advisor in the journey ahead. Reach out today!

Blog Disclaimer:

Please be advised that I am not a Certified Public Accountant (CPA), attorney, or lawmaker. The content provided on this blog, including all text, images, and other materials, is for informational purposes only and reflects my personal opinions formed through research.

The information shared on this blog should not be considered legal, financial, or professional advice. It is highly recommended that readers consult with a qualified professional, such as a CPA, attorney, or relevant expert, for specific advice tailored to their situation.

While I strive to provide accurate and up-to-date information, I cannot guarantee the completeness, reliability, or accuracy of the content presented on this blog. The use or reliance on any information contained on this site is strictly at your own risk.

Thank you for visiting and reading. Your understanding is appreciated.